Governor Bentley Announces Drop in Rate of Uninsured Motorists

By: Julie Magee, Alabama Department of Revenue Commissioner

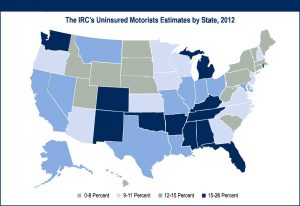

MONTGOMERY (Governor’s Office) – The Alabama Department of Revenue is pleased to announce that recent statistical review by our analysts has demonstrated that the uninsured motorists rate is now at 12.9%, which is almost half of what it was when the department started the legislatively mandated Online Insurance Verification System (OIVS). In 2010, the Insurance Research Council measured the Alabama rate of uninsured motorists at 22%, the sixth highest in the nation. In 2014 they stated we had dropped some to 19.6% but this was calculated prior to the start of the OIVS, using two year old data.

Why is this drop exciting and important? Actually, there are numerous valuable reasons. Probably the one most people care about the most is that responsible Alabama drivers are protected much better today than they were three years ago from being in an accident with an uninsured driver and being forced to call upon their own insurer to repair their vehicle. How unfair is it to be driving down the road, following all the rules and then being involved in an accident and having to pay your own deductible to repair your car? Now, due to the combined efforts of the Alabama Department of Revenue (ADOR), The Alabama Law Enforcement Agency (ALEA), the Alabama Department of Insurance (ADOI) and all the insurance companies operating in our state, the odds of this happening have been sliced almost in half.

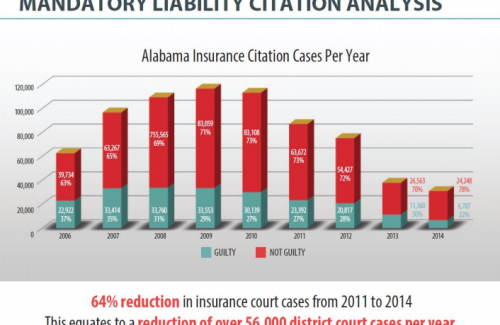

Another important reason is that there has been a 60% drop in citations given for driving without insurance in the past three years. This in turn caused a decrease of more than 56,000 court cases per year between 2011 and 2014. That represents a 64% reduction in insurance court cases for the same time frame! If you calculate all the expenses involved with the courts, lost productivity, travel expense, payroll, etc…the change to the way this is handled represents between $3.1-$3.7 million dollars per year in State and those who own cars in our state.

While not the impetus of the change, the OIVS has also increased revenue related to catching uninsured drivers. The Revenue Abstract available from the ADOR website reflects net collections related to MLI reinstatement fees as follows:

2015-16 (partial year – Oct. ’15 – May ’16) $2,014,535

2014-15 $2,197,536

2013-14 $1,128,334

2012-13 $ 892,121

And while ADOR is bringing more revenue, it is also shaved the cost of the program from a prior $590,000 per year annual expense to $321,000 this past fiscal year.

How is this different from the past? In the past, ADOR’s procedure was to pull random samples from the entire pool of automobile registrations operating in our state and mail to the address of record a letter asking for the owner of the car to enter their car insurance information on the form and mail it back in to ADOR. ADOR would then contact the insurance company to verify the information was accurate. If the process worked perfectly then the inquiry was closed. However, it is easy to see how things could go awry. Inquires could be mailed to an old address, lost in the mail, forgotten once received, or mailed back and lost along the way. Also, ADOR was sending these notices randomly so in essence putting a burden on insured and noninsured alike to prove they were following the law. This old process caused headaches, was not efficient and was costly. ADOR spent an average of $590,000 a year just handling a random shot at catching someone without insurance.

So, during the Bentley administration’s very first legislative session in 2011, ADOR Commissioner Julie Magee and her Motor Vehicle Department staff led by Deputy Commissioner Coone worked with legislators, The Alabama Department of Public Safety (now called ALEA), the ADOI, insurance agents and many representatives of the insurance industry and companies to create ACT 2011-688 aka OIVS. Most everyone recognized that change was needed but there were many different opinions on how to implement the change. The version that ended up in the legislation and eventually became reality, was recommended by Commissioner Coone and based on a model created by the Insurance Industry Committee on Motor Vehicle Administration (IICMA). A model that existed only on paper, no working model had ever been created in any state prior to Alabama adopting this model. However, it was the best choice because it allows requesting parties to go directly to the source of insurance information – the insurance companies. The OIVS allows a real time response to be provided to an insurance inquiry that contains standardized request information. Most responses to requesting parties are returned in less than a second. It uses a simple web service that poses no drain on any server or technological resource, is secure and best of all is REAL TIME. All it does is ask the insurance company insuring the car if the car is insured right now and in less of a second, the law enforcement official, the local county tag office official or ADOR staff in Montgomery, get an answer. More than 200 insurance companies are integrated with the OIVS.

The program’s success is highly attributable to its integration with law enforcement systems. ALEA has reported benefits from the OIVS including officer safety at the roadside due to less time spent out of the vehicle obtaining insurance documentation from the vehicle driver, having policy information available from the system ensures accuracy of the policy information because the officer does not have to view and enter the policy number unless he/she obtains an unconfirmed response from OIVS, and there is less manpower needed related to processing citations issued for no insurance. Using OIVS proves a benefit to law enforcement personnel as well as the public related to citations issued for no insurance. Prior to OIVS, a vehicle operator who could not produce a copy of the evidence of insurance on the vehicle to a law enforcement officer would be subject to receiving a citation for no insurance. The vehicle owner/operator would then be required to make a court appearance to produce a copy of the insurance document just to have the citation dismissed. Such cases resulted in increased fees/expenses for the court system as well as citizens who were required to take time off from work in order to appear in court to answer to the citation.

Insurance agents and the companies they represent are also huge fans of the OIVS. The fact that what they once had to do via phone, fax or in person is now done programmatically in less than a second means a much better use of their time and is a great example of how government can provide customer friendly services that benefits everyone.

The OIVS is a tremendous illustration of a project that truly demonstrates how government agencies should work together to provide more effective and efficient services for its taxpayers.

Provided by the Office of the Governor of Alabama | governor.alabama.gov